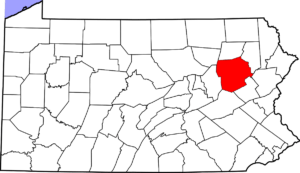

Pennsylvania Limited Tort Lawyers – Wilkes Barre, Scranton, Hazelton

The PA Limited Tort Lawyers at Simon & Simon work tirelessly to serve clients throughout Luzerne County. Our limited tort attorneys have successfully obtained settlements for plaintiffs injured in Scranton, Wilkes, and Hazelton car accidents with Limited Tort. If you have been injured in an auto accident in Luzerne County, call the limited tort lawyers at Simon & Simon now!

Talk to a PA Limited Tort Lawyer in Luzerne County About Your Car Accident

We provide aggressive representation in order to obtain compensation for our Luzerne County clients with limited tort. We obtain all the required insurance documents for you, and work with the insurance companies so that you return to your daily life.

Simon & Simon represents limited tort injury clients throughout Luzerne County, including in the following communities:

- Wilkes-Barre

- Hazelton

- Ardmore

- Yeadon

- Broomall

- Darby

- Landsdowne

- Woodlyn

- Collingdale

- Folsom

- Brookhaven

- Glenolden

- Ridley

- Clifton Heights

LIMITED TORT FAQs

In Pennsylvania, you have the right to elect one two (2) types of automobile insurance; full tort or limited tort. While more expensive than the limited tort alternative, full tort coverage removes significant hurdles that would otherwise stand in the way of fair recovery. With full tort status, you have the statutory right to financial recovery for ANY injury and the resultant pain and suffering, loss of life’s pleasures and embarrassment and humiliation after a car accident. Full tort insurance offers the greatest protection when insurance companies that try to deny you fair compensation for your injury.

Many Pennsylvanians are led to believe that limited tort mean they cannot sue for “non-economic damages” (bodily injury causing pain and suffering, loss of life’s pleasures and embarrassment and humiliation. Fortunately, that is simply not true. Limited tort does NOT take away your right to sue. However, it does make it more difficult to win your case. In order to recover, you will not only have to prove that you suffered an injury, but that your injury constitutes a “serious impairment of a bodily function.” Once you’ve overcome that threshold, the limited tort plaintiff is held to the same standard a full tort victim.

Whether full tort or limited tort, you always have the right to sue for “economic damages” (medical expenses, lost earnings, damage to your vehicle). The difference between full and limited tort only applies to “non-economic damages”, otherwise known as i) pain and suffering, ii) loss of life’s pleasures and iii) embarrassment and humiliation. The more expensive full tort option places no restrictions whatsoever on the right to seek financial compensation for bodily injury. Limited tort, on the other hand, is less expensive. But by paying less for your premiums, you are limiting your right to monetary recovery for “serious” injuries only.

When buying car insurance In Pennsylvania, you have the choice to purchase either limited tort or full tort coverage. While less expensive, limited tort coverage can make your fight for compensation more difficult. With the cheaper limited tort option your right to recover money for pain and suffering is limited to only injuries that constitute a “serious impairment of a bodily function” injury. On the other hand, the costly full tort option has no limits on your right to recover.

Fortunately, however, Pennsylvania law carves out five (5) “exceptions” that automatically give you full tort rights even if you only paid for a limited tort insurance policy:

- THE DRUNK DRIVER EXCEPTION. If you’re hit by a driver who is convicted of or agrees to Alternative Rehabilitation Disposition (ARD) for DUI, you will be deemed full tort in any injury claim against the drunk driver.

- THE OUT-OF-STATE VEHICLE EXCEPTION. If you’re hit by a vehicle registered in any state other than Pennsylvania, you can recover damages as if you elected full tort coverage.

- THE COMMERCIAL VEHICLE EXCEPTION. If you are injured while driving, or a passenger in, a commercial vehicle (bus, taxi, rental car, etc.), you automatically retain full tort rights even if you have your own limited tort policy.

- THE UNINSURED DEFENDANT EXCEPTION. If you’re injured by a driver who does not have any valid car insurance, you will be full tort for your pain and suffering claims against the uninsured defendant.

- THE INTENTIONAL COLLISION EXCEPTION. If another driver hits you purposefully, intending to hurt you, you will have the unlimited right to recover pain and suffering money against him.

We Serve all of Pennsylvania for Limited Tort

Simon & Simon has recovered millions in settlements and awards in all counties across Pennsylvania. Our Limited Tort lawyers have a successful reputation for handling PA limited tort injury cases in all counties including:

- Montgomery County

- Chester County

- Lehigh County

- Allegheny County

- Beaver County

- Luzerne County

- Delaware County

- York County

- Dauphin County

- Butler County

- Clarion County

- Lackawanna County

- Bucks County

- Lancaster County

- Susquehanna County

- Erie County

- Indiana County

You Can Still Recover Money with Limited Tort

Simon & Simon Has Recovered Millions in Limited Tort Settlements and Verdicts

Simon & Simon takes the cases the most lawyers throughout PA and New Jersey do not want. Insurance companies have made limited tort cases very difficult, and requires a lawyer with specialized knowledge about the law. Just a few of our many recent results:

$700,000 Mediated Settlement for Limited Tort Plaintiff

Who was rear-ended In Philadelphia County. Defendant settled during a 1 day mediation conference.

$185,000 Settlement for Limited Tort Plaintiff

In Landsdowne, from an accident where a commercial tanker truck rear-ended her vehicle and pushed it into oncoming traffic.

$142,500 Settlement for Limited Tort Plaintiff

Plaintiff was injured when he was sitting in his car and defendant’s truck hit the driver’s side of his front bumper and ripped it off causing herniated disks and nerve damage to Plaintiff.